American politics is keeping everyone on their toes. The notoriously unpredictable Trump administration is causing international concern as the US shows signs of more protectionist trade policies.

As the talk of the trade war just starting to settle down, many nations are watching American politics through the gaps between their fingers. With President Donald Trump pushing for new import tariffs on aluminium (25 %) and steel (10 %), some have started to wonder who’s getting the short end of the stick in global economics.

What are the specialist saying?

In an age of uncertainty, “fake news”, “alternative facts” and the newly discovered power of Twitter, political scientists are keeping busy deciphering it all. At the University of Sydney, Glen S. Fukushima, former Deputy Assistant USTR for Japan and China at the Office of the United States Trade Representative in the late 1980s, spoke on bilateral trade imbalances, multilateral trade adjustment and restrictive trends that have replaced expansive ones under the current trade conditions.

Or, to put it in laymen terms, Fukushima spoke on how US import taxes such as tariffs on steel and aluminium are meant to boost national production. Trade barrier such as these slow down global trade, which, ultimately, slows down global growth, followed by implications for the stock markets worldwide. But such drastic tariffs could affect the global economy negatively.

“Transgression in American politics makes room for new rising powers to steer the global economy,” Fukushima told upstart.

“What this will look like, only time will tell,”

US Protectionism

After leading his campaign with an America First ideology, and imposing tariffs on steel and aluminium checks off one of the Trump administrations main goals: protecting jobs for American steelworkers. But is this really the case?

The sector has seen a decline in employment, with many positions disappearing as a result of automation and globalisation. In fact, it would take years of economic adjustment for the sector to see employment growth based on these tariffs alone.

Using a loophole provision in the Trade Expansion Act of 1962, Trump is able to enact trade barriers without congressional approval. This provision argues that if the US finds that its access to materials is unreliable for means of national security, it has the ability to set up trade barriers in order to stimulate domestic production of such materials. Steel, a vital material for the US defence technology, is the metal in question.

The White House has delayed decision on steel and aluminium tariffs but international community has already begun to react and threaten with retaliation.

Will this cause a trade war?

As a result of Trump’s new tariff, many fear a trade war.

What makes this more dramatic than a normal trade dispute is the “uncontrolled” escalation of trade barriers between one country to another, Phil Levy, a senior official on President George W. Bush’s council of economic advisers told Vox.

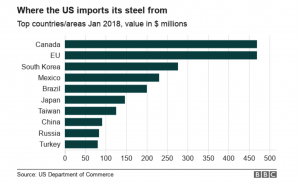

The issue is that the tariffs on aluminium and steel could end up affecting everyone but the administration’s set target: China. While the US is the biggest importer of steel, and China is the biggest producer of steel, the effects of these trade barriers will most likely be felt by Americas closest allies.

The real battle and focus of Sino-American trade relations is in imbalances that exist in the “growing economic and strategic rivalry between China and the USA in the high-tech, innovative sector,” Dr. James Leibold, associate professor of Chinese politics at La Trobe University, tells upstart.

“This ‘poker game’ hasn’t finished, and it’s possible that Xi might call Trump’s bluff and we could descend into a full-scale trade war,” he said.

Why does it matter to Australia?

“China and the USA are our two largest trading partners. Any trade-war between the two countries could be disruptive to [Australia’s] economy, mainly through stock market volatility,” Leibold said.

And the international community is not taking Trump’s tariffs lightly.

The EU has already put out a list of products it is willing to hit, ready to retaliate if the Trump administration moves forward with implanting tariffs on steel and aluminium.

Similarly, a senior Chinese government official in Beijing spoke on the country’s willingness to “retaliate immediately, intensively, without hesitation” to U.S tariffs, according to Bloomberg.

U.S trade official Robert Lighthizer, announced at the House Ways and Means Committee hearing that the Trump administration is reviewing the exception of Australia, Argentina, and the European Union.

While the decision of who would be exempt would come down to president Trump, conversations about exemption have continued beyond its set date of April.

“The trade adjustments mean more than just numbers that make up the economy,” Marc Perrier said on TOPlive.

“Changes in trade can rearrange everything from entry-level employees to Wall Street.”

Annette L Espinoza is a third-year exchange student from The College of New Jersey pursuing a bachelor degree in political science with a minor in journalism and professional writing.